Has Labubu Fever Peaked? Check Your Map.

Labubu’s peak isn’t a date on the calendar—it’s a dot on the map.

Labubu isn’t fading—in fact, it’s still burning white-hot in places you might not expect.

A fresh scrape of Google Trends (pulled yesterday, 29 June 2025) lays out a multi-wave storyline of Labubu hype. In this post: Wave 1 crested across Southeast Asia last summer, Wave 2 spiked in Mexico over the holidays, and Wave 3 is climbing right now from Houston strip-malls to Riyadh souqs and São Paulo sneaker pop-ups. The five micro-charts below pin down the exact week each market either blew its top or flipped the ignition switch.

Each chart is a raw image export from Glimpse’s Google‑Trends interface.

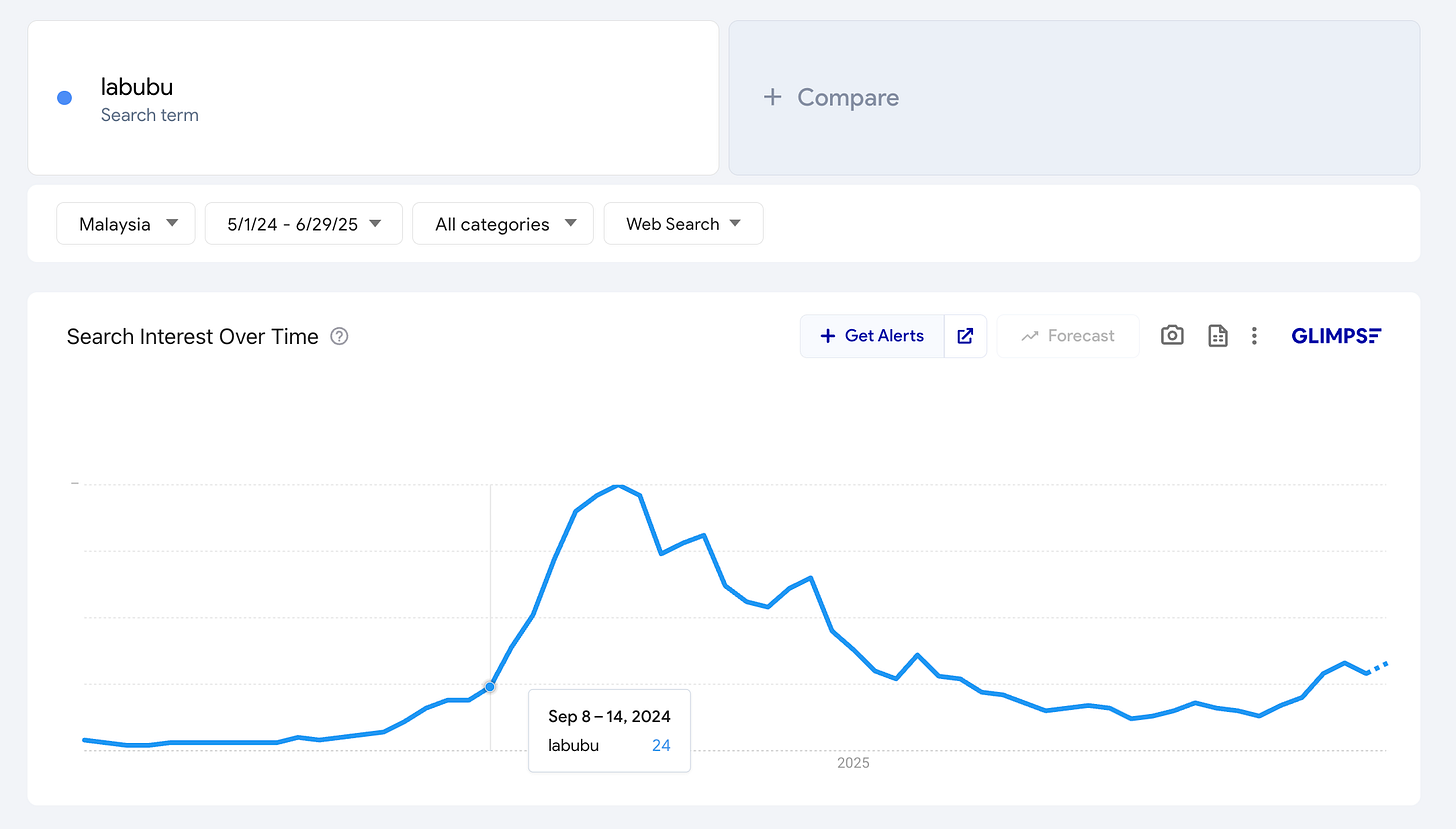

Malaysia — First Wave, First Crash

The first measurable wave of Labubu interest outside mainland China began in spring 2024, within hours of BLACKPINK’s Lisa exposing herself as a fan of Pop Mart. Malaysia’s wave hit later that summer. By October 2024, The Star was profiling teens who had already spent tens of thousands of ringgit chasing Labubus, some paying up to RM 900 apiece and flying to Bangkok for stock. The frenzy pushed Google searches towards their all-time high around the week of Malaysia Day—but supply soon outstripped FOMO. By Chinese New Year, search results took a dip.

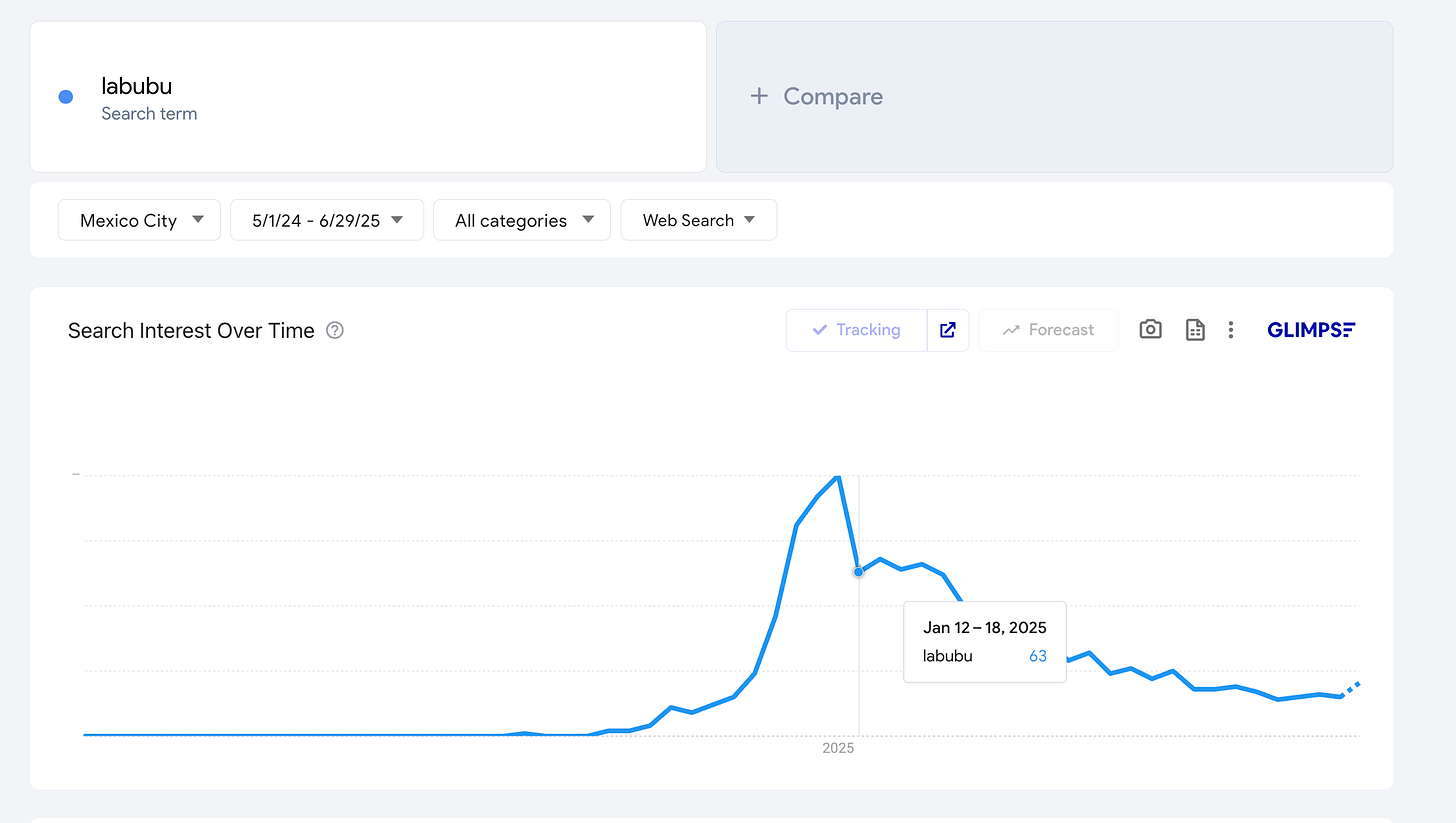

Mexico City, Mexico — Holiday Roar; New Year’s Dive

With no permanent Pop Mart store yet on Mexican soil, demand burst online first. Around the end of 2024, Excélsior pointed readers looking for Labubus to cross-border resellers and the Balderas Metro market in Mexico City. Google searches climbed for four more weeks, topping out in early January as holiday hauls hit TikTok. Then the bottom dropped out, and attention migrated north to the U.S. For a deeper dive on the market’s quirks, see our Mexico primer.

United States — Riding a High Plateau

America hasn’t crashed—it’s catching its breath. When Pop Mart opened yet another Houston-area store on 19 May, crowds rushed the mall hours before it opened, according to the Houston Chronicle. By the end of June, Forbes declared Labubu 2025’s “unexpected fashion trend,” crediting TikTok for the monster’s overnight ubiquity. The resale market agrees: Pop Mart is StockX’s No. 1 traded collectibles brand, a title it has held since October 2024 thanks to Labubu’s surge. The U.S. wave hasn’t rolled over; it’s on a high plateau.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Riyadh Province, Saudi Arabia — The Rocket Still Climbing

The Gulf caught Labubu fever later—but hard. When Pop Mart’s tie-dyed Big Into Energy series landed in Dubai in April, Saudi fans piggy-backed through delivery apps and cross-border couriers. Google searches in Riyadh exploded, noted South China Morning Post. Our own Gulf primer confirmed the same mid-May crest before interest bounced higher. Riyadh is in late-takeoff mode, but the Labubu trend around the Gulf is just beginning.

Brazil — A New Wave Begins

Brazil is living what Malaysia did a year ago—only faster. On 10 June 2025 the business daily Valor Econômico headlined “Labubu vira fenômeno nas redes”, noting Pop Mart’s Hong Kong stock had soared on the hype. Two weeks later Veja called the plush “feio, ingênuo e gracioso” and warned of fake-seller scams popping up on WhatsApp and Instagram. O Globo chimed in that consumers were addicted to the dopamine hits from blind-box hits (27 Jun). Every sign points to Brazil still in its manic-growth phase. The dotted forecast on the chart hints the vertical isn’t finished.

After the Peak? More Queues, Just Without Tents

In Singapore—where Google searches peaked in October 2024—fans started lining up at 5:30 a.m. outside Ion Orchard the moment a snack-themed drop hit shelves last weekend. Meanwhile in Seoul, staff say “the number of people coming in is just like before—except now we don’t see tents,” proof that the buzz outlives the toy itself even after Korea pulled Labubu over safety worries. Translation? Post-peak markets don’t go quiet; they simply swap sleeping bags for shopping baskets, and wait for the next monster to drop.